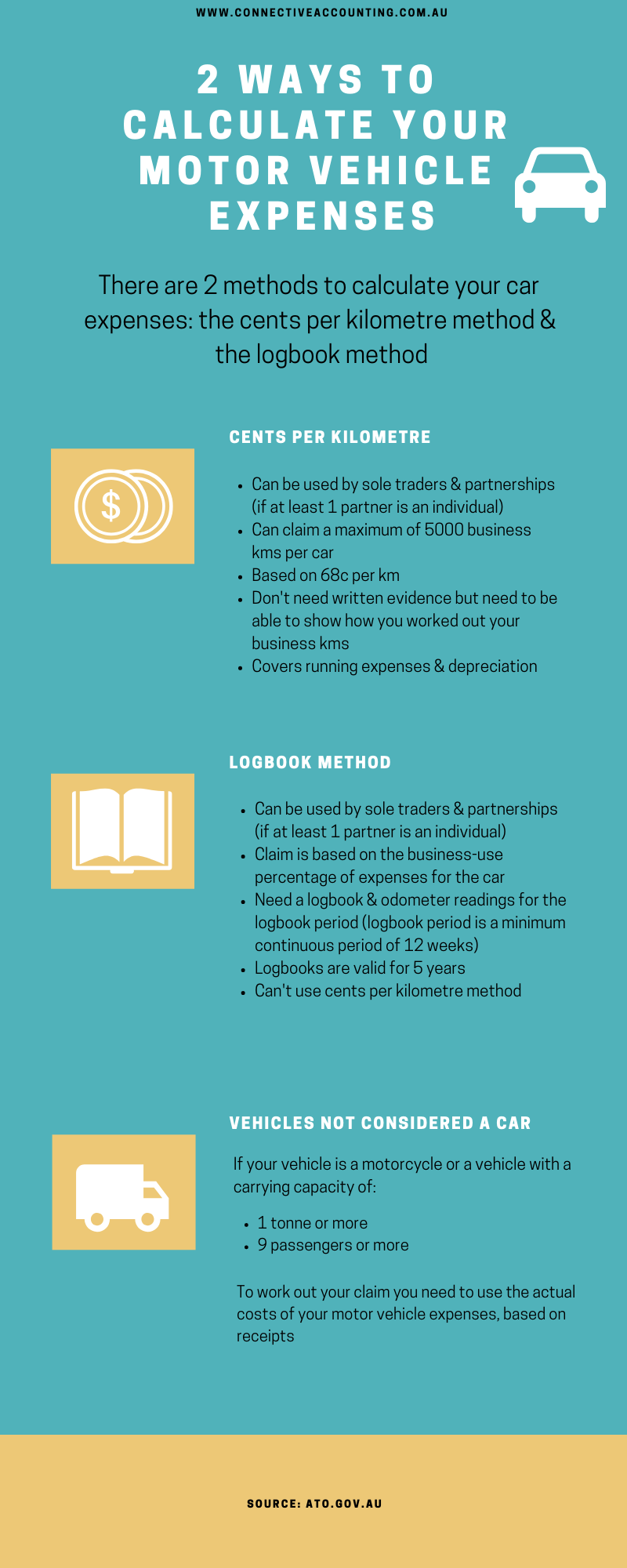

Claiming Motor Vehicle Expenses: Cents Per Kilometre Method v Logbook Method — Connective Accounting

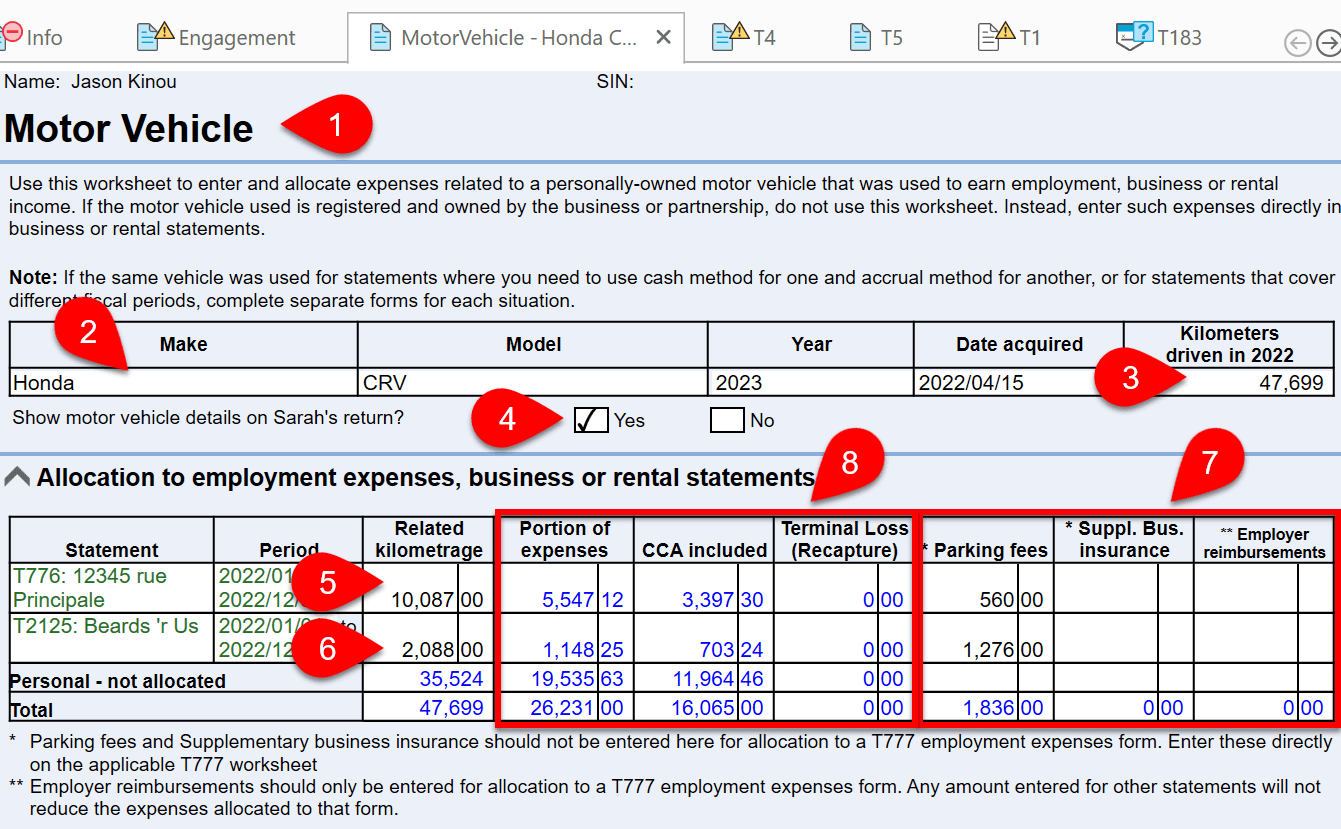

Motor Vehicle Expenses as per CRA - You may want to know before buying a new vehicle to be used in your business. - RKB Accounting & Tax Services